Lloyd’s today announced a loss of £0.9bn (pre-tax) for 2020, driven by £3.4bn net incurred COVID-19 losses, which contributed 13.3% to the market’s combined ratio of 110.3%.

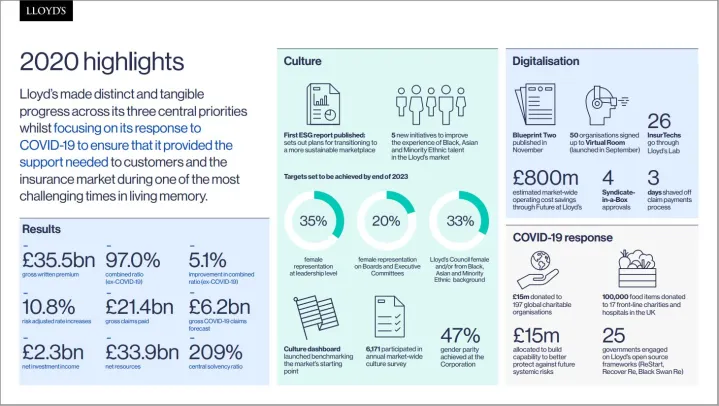

Excluding COVID-19 claims, the market’s combined ratio has shown substantial improvement at 97.0%, down from 102.1% in 2019.

The key figures reported in Lloyd’s 2020 Full Year Results are:

- Gross written premiums of £35.5bn (2019: £35.9bn)

- Combined ratio of 110.3 % (2019: 102.1%)

- Attritional loss ratio of 51.9% (2019: 57.3%)

- Net investment income of £2.3bn, 2.9% return (2019: £3.5bn, 4.8% return)

- Net resources of £33.9bn (2019: £30.6bn)

- Central solvency ratio of 209% (December 2019: 238%)

Excluding COVID-19 losses, the market delivered an underwriting profit of £0.8bn, demonstrating a significant improvement in Lloyd’s underlying performance. This is supported by 7.8 percentage point improvement of the underlying combined ratio (attritional loss ratio, expense ratio and prior year releases) which has dropped to 87.3%.

Gross written premiums of £35.5bn represent a 1.2% reduction over the same period in 2019. Exceptional market conditions driven by an acceleration in positive rate momentum throughout 2020 saw the market achieve average risk adjusted rate increases on renewal business of 10.8%. This was offset by a 12.0% reduction in GWP due to the remediation of underperforming business in 2020, reflecting the market’s continued focus on the quality of the business it renews and underwriters.

The 2020 expense ratio saw a 1.5% improvement dropping to 37.2% (2019: 38.7%), and this remains a key area of focus, with the Future at Lloyd’s Blueprint Two solutions and delivery programme central to tackling total acquisition costs and administration expenses.

In 2020, the market’s net resources increased by 10.8% to £33.9bn as at 30 December 2020 (2019: £30.6bn), reinforcing the exceptional strength of Lloyd’s balance sheet with a central solvency ratio of 209% (December 2019: 238%).