Lloyd’s Europe can accept risks and issue policies via the following entities:

How to place a risk with Lloyd’s Europe

Lloyd’s Europe registered brokers

Registered brokers bring risks to the Lloyd’s Europe underwriters on behalf of clients, using their specialist knowledge to locate the best underwriters and negotiate competitive terms and conditions.

Lloyd’s Europe Service Companies

Lloyd’s Europe has a network of service companies across Europe, providing specialist underwriting expertise to their local markets. Contact your nearest European branch to find a service company in your country.

Lloyd’s Europe Coverholders

There are additional underwriting agencies (known as coverholders) across Europe issuing policies on behalf of Lloyd’s Europe direct to brokers and clients. Contact your nearest Lloyd’s European branch to find a coverholder in your country.

Market Directory

Find all organisations that operate within the Lloyd’s market in our Market Directory.

How to join Lloyd’s Europe as a broker

Our Accessing Lloyd’s Europe Guide is aimed at European brokers wishing to understand the most suitable options to access Lloyd’s Europe, as well as the essentials of risk placement and processing on the Lloyd’s Market.

Download the Accessing Lloyd’s Europe guide by clicking one of the links below:

Strong financial protection across Europe

Because they are 100% reinsured back to Lloyd’s Syndicates, LIC policies benefit from the same excellent financial ratings as Lloyd’s, so you can be sure placing risks with Lloyd’s Europe is safe and secure.

A+

Superior

A.M. Best

AA-

Very Strong

Fitch Ratings

AA-

Very Strong

Kroll Bond Rating Agency

AA-

Very Strong

Standard & Poor's

A strong Chain of Security

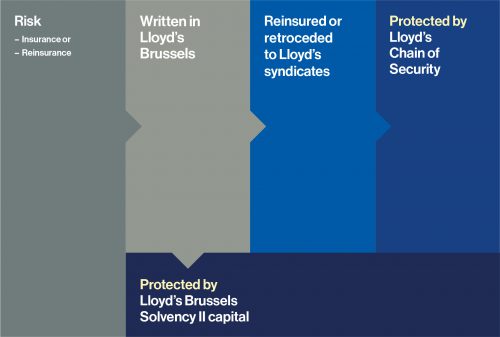

Lloyd’s Europe also benefits from Lloyd’s central resources, including the Lloyd’s Central Fund. As all Lloyd’s Europe policies are 100% reinsured back to Lloyd’s syndicates, they are ultimately backed by Lloyd’s unique capital structure, often referred to as the Chain of Security.

Both insurance and reinsurance policies placed with Lloyd‘s Europe benefit from the stability of the Lloyd’s Chain of Security. In addition, Lloyd’s Europe holds its own Solvency II capital for further protection.

€62bn

Link one:

Syndicate level assets

€33bn

Link two:

Members’ funds at Lloyd’s

€4bn

Link three:

Central assets

Foreign Account Tax Compliance Act (FATCA)

Lloyd’s Europe does not write US risk. For insurance premium, including US premium, paid to Lloyd’s syndicates, the single Lloyd’s market W-8 IMY will be sufficient for FATCA purposes.